Updated March 15, 2024

Why a loan?

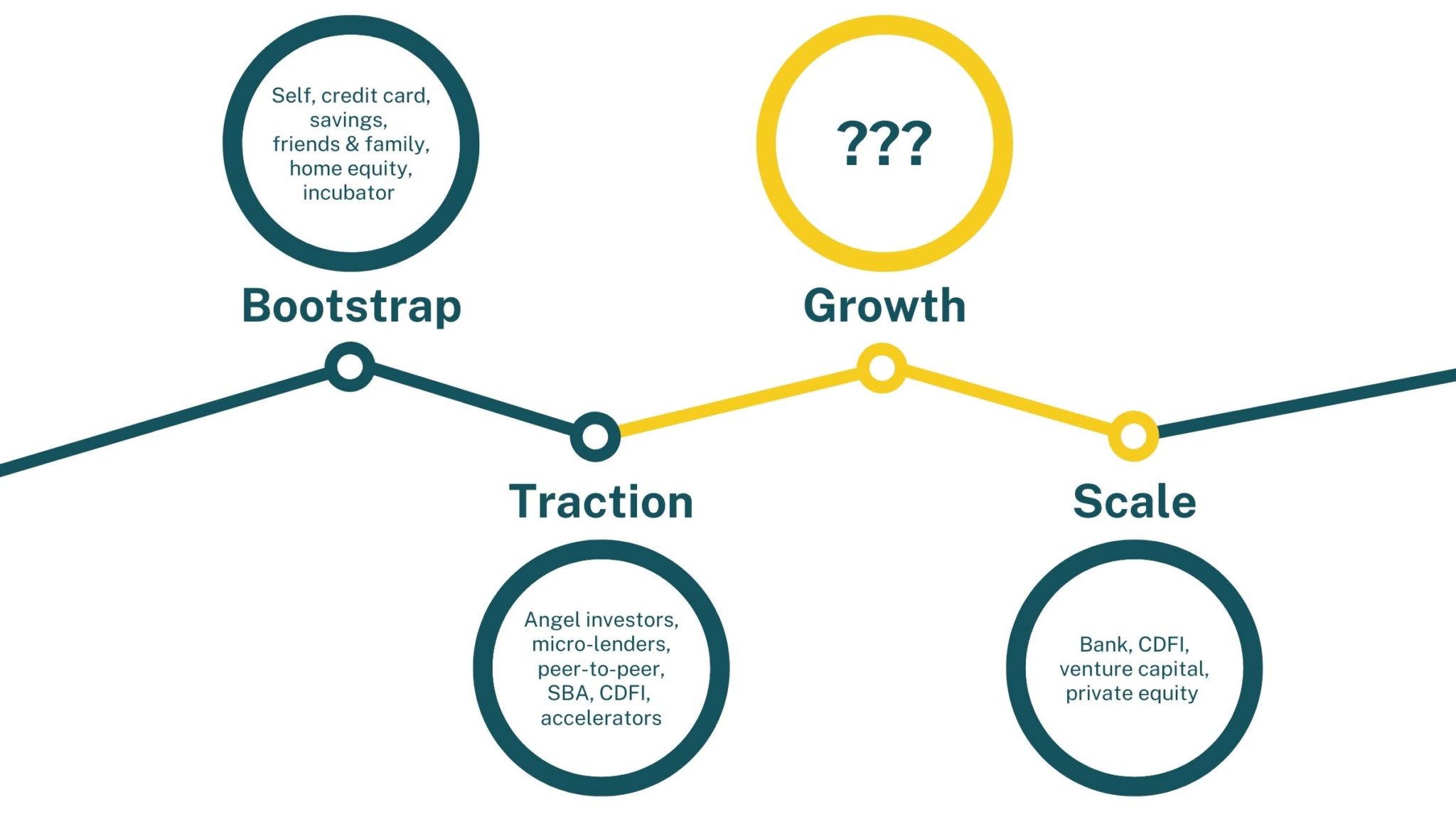

When your business is ready to grow and expand, but you find yourself in an awkward, in-between space—you’ve outgrown microfinance and often SBA loans, but don’t quite fit bank loan criteria.

That’s where we come in.

You might need something that other investors and highly regulated traditional banks can’t offer.

At Mission Driven Finance, we use flexible capital to support community leaders like you—changemakers with bold visions and innovative enterprises.

1. What types of loans can I get with Mission Driven Finance?

Here is a quick overview of our loan options*:

- Southern California and across the U.S.

- Small businesses and nonprofits doing good in your communities

- Amounts in the $100,000–$1.5 million range

- Terms of 3–30 months

- No prepayment penalty fee

- No credit scores required

- No personal guarantees required

- Islamic financing available

- Revenue-based financing available

See each of these options for more information:

2. Do I qualify?

What we look for:

- Impact—businesses and nonprofits that are tied into their community and want to do more

- Management—leaders that are smart, driven, honest, and coachable

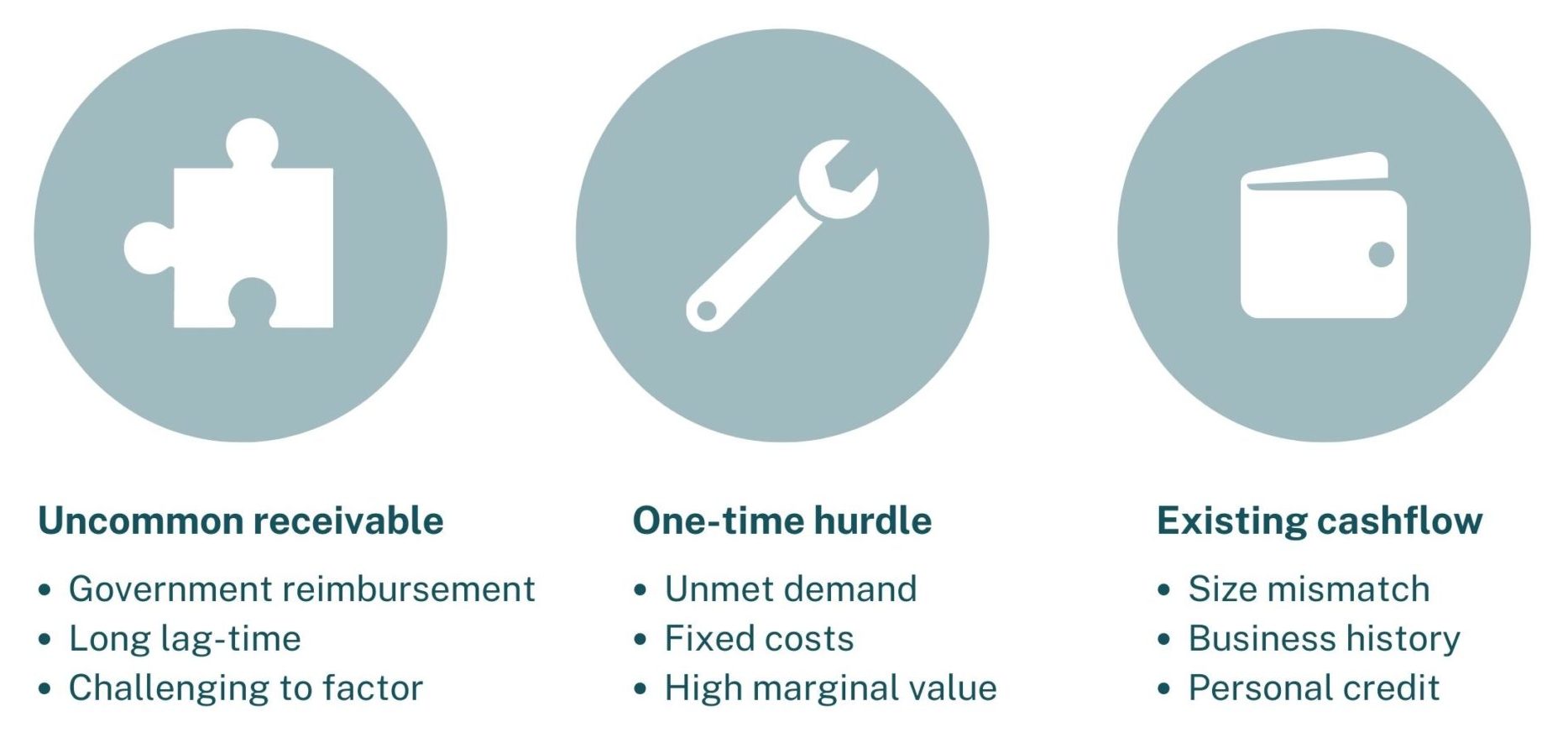

- Finance—proven revenue to repay a loan, but not a fit for other investors due to one of the financial challenges below.

The types of capital gaps we fill:

What we don’t require:

- Personal credit scores

- Owning a house or using personal assets as security

- Simple business structures

3. What do you mean by “impact?”

If you’re committed to doing good in your community and for our planet—either by the jobs you provide or the products and services you offer, you can make an impact.

Check out some of our portfolio companies for examples.

“We started out with $1 million in revenue in 2019 and now report $5 million in revenue just two years later. We started out with eight employees and now employ 34. This tremendous growth couldn’t have happened without the support of partners like Mission Driven Finance. While we are now in a better position to work with banks and other traditional lenders, we would still love to continue to work with Mission Driven Finance for our path of growth and success.”

— Tri Le, Co-founder & CEO, Microtek (portfolio company)

Not sure if your business qualifies? Reach out and we’ll chat through what you’re doing now and what you could be doing to increase your impact. We also encourage you to submit an inquiry form so we can get to know you and your business before we chat.