We were at the White House to share about our new Indigenous Futures Fund—designed to accelerate the flow of capital to Native entrepreneurs and Tribal enterprises.

racial equity

Supporting diverse emerging fund managers

Lauren Grattan spoke on an Impact Finance Center and Boston Impact Initiative panel on how backbone organizations like Common Future and Mission Driven Finance are driving diversity, equity, and inclusion in the world of emerging managers.

World Education Services inaugural investee partner gathering ahead of SOCAP23

Ahead of SOCAP23, World Education Services brought together partners to forge trust, nurture relationships, share expertise, and gather insights on how we can collectively influence the field.

David Lynn on employee ownership at Impact Investor Summit

CEO David Lynn and co-panelists shared insights about employee ownership at New Private Markets’ Impact Investor Summit: North America.

Interview with Fibers Fund’s Sarah Kelley and Teju Adisa-Farrar

“The Fibers Fund is designed to be catalytic by taking a holistic approach that helps fiber entrepreneurs receive the right-size capital and targeted support that they need to grow their business.”

Impact(ed) podcast: Foundations with Essma Bengabsia

Essma Bengabsia (The Annie E. Casey Foundation) talks about the untapped power and potential of philanthropy’s approach to investing, as well as how her community and identities have led her to be an impact investor at a $3 billion foundation.

San Diego Habitat for Humanity Announces Expanded Investment from Mission Driven Finance

San Diego Habitat for Humanity received new investments through impact asset manager Mission Driven Finance, expanding on their prior collaboration.

Vice President Kamala Harris Announces New Investment Fund to Expand Access to Capital for Entrepreneurs of Color

At the Freedman’s Bank Forum, VP Harris and the Initiative for Inclusive Entrepreneurship (IIE) announced new dedicated investment vehicles with a goal of raising $80 million in private and philanthropic capital to leverage federal funding for entrepreneurs of color.

Native Women Lead & The Future is Indigenous Women’s Inaugural Growth Capital Summit 2023

Lauren Grattan spoke at Native Women Lead & The Future is Indigenous Women’s Inaugural Growth Capital Summit, where over 120 Native women entrepreneurs, investors, and mentors gathered for three days of connection.

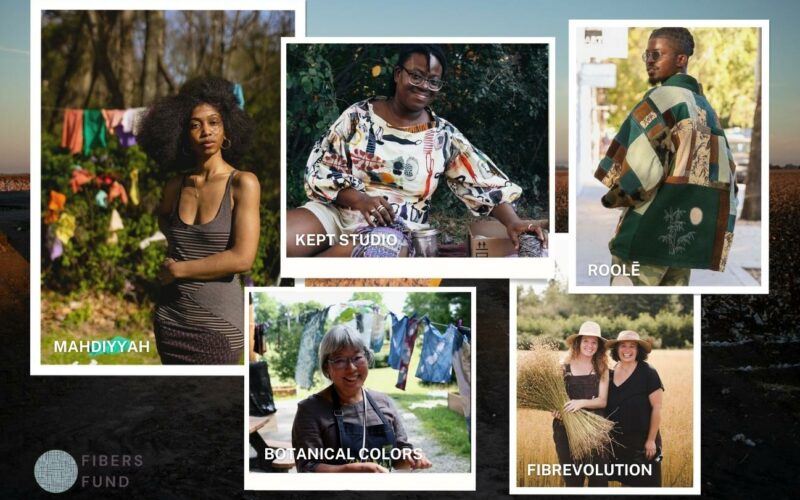

Fibers Fund announces first 5 grantees

Meet the first five grantees of the Fibers Fund: Botanical Colors, Fibrevolution, MAHDIYYAH, Kept Studio, and ROOLĒ.

WEPOWER Capital invests nearly $250k in St. Louis Black & Latinx-owned businesses

Since its launch, WEPOWER Capital has invested in 3 St. Louis Black and Latinx-owned companies: Bold Xchange, RooterMan by J3 Enterprises, and Cheryl’s Herbs.

Meet the 2023 members of the Advance Advisory Committee

These regional community champions ensure the flow of Advance Strategy capital to underserved and overlooked communities.

Access Youth Academy — Where Are They Now?

Three years ago, a $12M project was designed to transform the lives of the youth in Southeast San Diego with Access Youth Academy.

Thank you to our 2nd fellowship cohort!

Today concludes our formal year of learning together with the second cohort of the Community Finance Fellowship at Mission Driven Finance. Join us in extending a huge thanks to them for a fruitful year together!

Seeing the impact in person

Our distributed team got together in real life in San Diego for a team retreat to connect with each other and our mission.

Mission Driven Finance supports Starbucks Community Resilience Fund mobilizing capital for racial equity

Mission Driven Finance and Next Street are partnering with Starbucks to advance racial equity and environmental resilience.

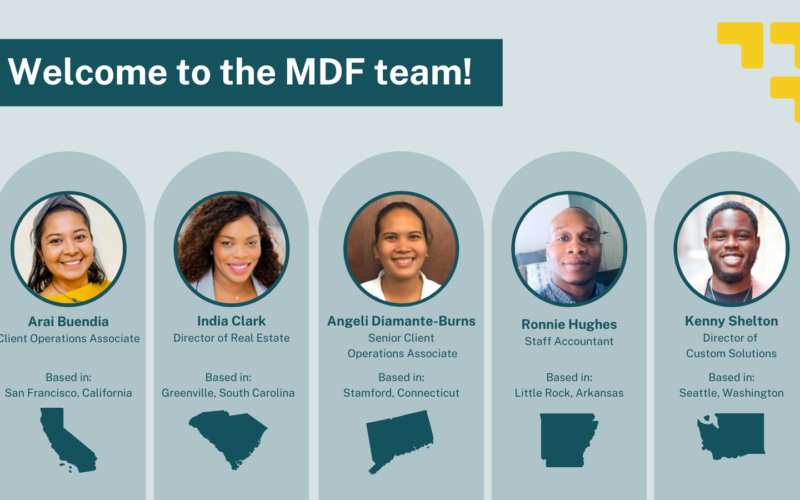

Internal promotions & new team members help us prep for rocket launch

Mission Driven Finance is growing and we are welcoming 5 new hires and 4 internal promotions. Celebrate the growth with us!

Over $5 million disbursed to San Diego nonprofits in 0% interest loans

It’s official—the San Diego County COVID-19 Small Business and Nonprofit Loan Program (SBNLP) has successfully disbursed $5.2M to nonprofits in San Diego County impacted by COVID-19.