Getting capital to flow where it doesn’t but should

Getting capital to flow where it doesn’t but should

What we do

Using finance as a tool for change

Good businesses often don’t have sufficient, affordable access to capital. That’s why Mission Driven Finance was built with a single purpose—to make it easy to invest in your community.

All the funds and structured products you will find here are designed to close financial gaps in order to close opportunity gaps: impact investment opportunities that are simple, transformative, and aligned.

assets into the community

Mobilizing capital that will increase inclusive and equitable access to education, health, and wealth

small businesses & nonprofits supported

The figures above are accurate as of March 31, 2025.

Advance Strategy portfolio makeup

Advancing an inclusive economy

%

Nonprofits

%

Owned or led by women

%

Owned or led by people of color

The figures above are accurate as of December 31, 2024.

All information is reported since the inception of the Advance Strategy.

Letters from Lauren: June 2025

Mission Driven Finance has helped flow $200 million in assets into community, doubling volume in under two years! This capital supports impact-minded entrepreneurs, businesses, nonprofits, and real estate projects, creating an inclusive, robust economy. We’ve moved this money through a variety of vehicles that help us and our stakeholders stay nimble and resilient in a shifting marketplace.

Why the care economy is everyone’s business (and what to do about it)

The sandwich generation, or maybe more accurately, the panini generation—crushed by the pressures of caring for both aging parents and young children—feels familiar to many. Yet, the care economy remains a massively underinvested opportunity hiding in plain sight.

“Assets into community” now at $200M, skyrocketing by $100M in two years

Our team is celebrating a huge milestone: We’ve disbursed over $200 million in assets into community as of April 30, 2025!

Letters from Lauren: June 2025

Mission Driven Finance has helped flow $200 million in assets into community, doubling volume in under two years! This capital supports impact-minded entrepreneurs, businesses, nonprofits, and real estate projects, creating an inclusive, robust economy. We’ve moved this money through a variety of vehicles that help us and our stakeholders stay nimble and resilient in a shifting marketplace.

Why the care economy is everyone’s business (and what to do about it)

The sandwich generation, or maybe more accurately, the panini generation—crushed by the pressures of caring for both aging parents and young children—feels familiar to many. Yet, the care economy remains a massively underinvested opportunity hiding in plain sight.

“Assets into community” now at $200M, skyrocketing by $100M in two years

Our team is celebrating a huge milestone: We’ve disbursed over $200 million in assets into community as of April 30, 2025!

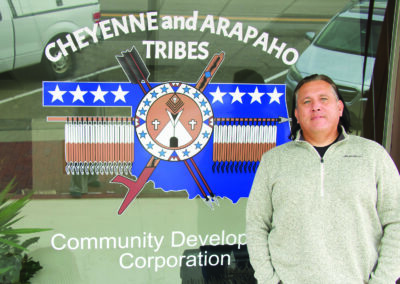

How to get values-aligned funding: Lessons for entrepreneurs from Trading at the Bay

All too often, entrepreneurs, especially those building businesses rooted in community and values, hit a wall trying to access capital that aligns with their mission. See our takeaways from speaking with funders and entrepreneurs.