Care Access Real Estate

A Real Estate Investment Trust

Why we invest in real estate for early care & education

A Real Estate Investment Trust for Child Care

Across the country, families need child care but many have a hard time finding it due to a lack of licensed child care availability in their area. Many can agree that we need to grow and stabilize the supply of licensed child care to support children, families, workers, and the community.

One way to do that is by growing the capacity of existing quality child care providers who rarely get the opportunity to expand, consistently naming real estate issues as stressors and barriers to growth.

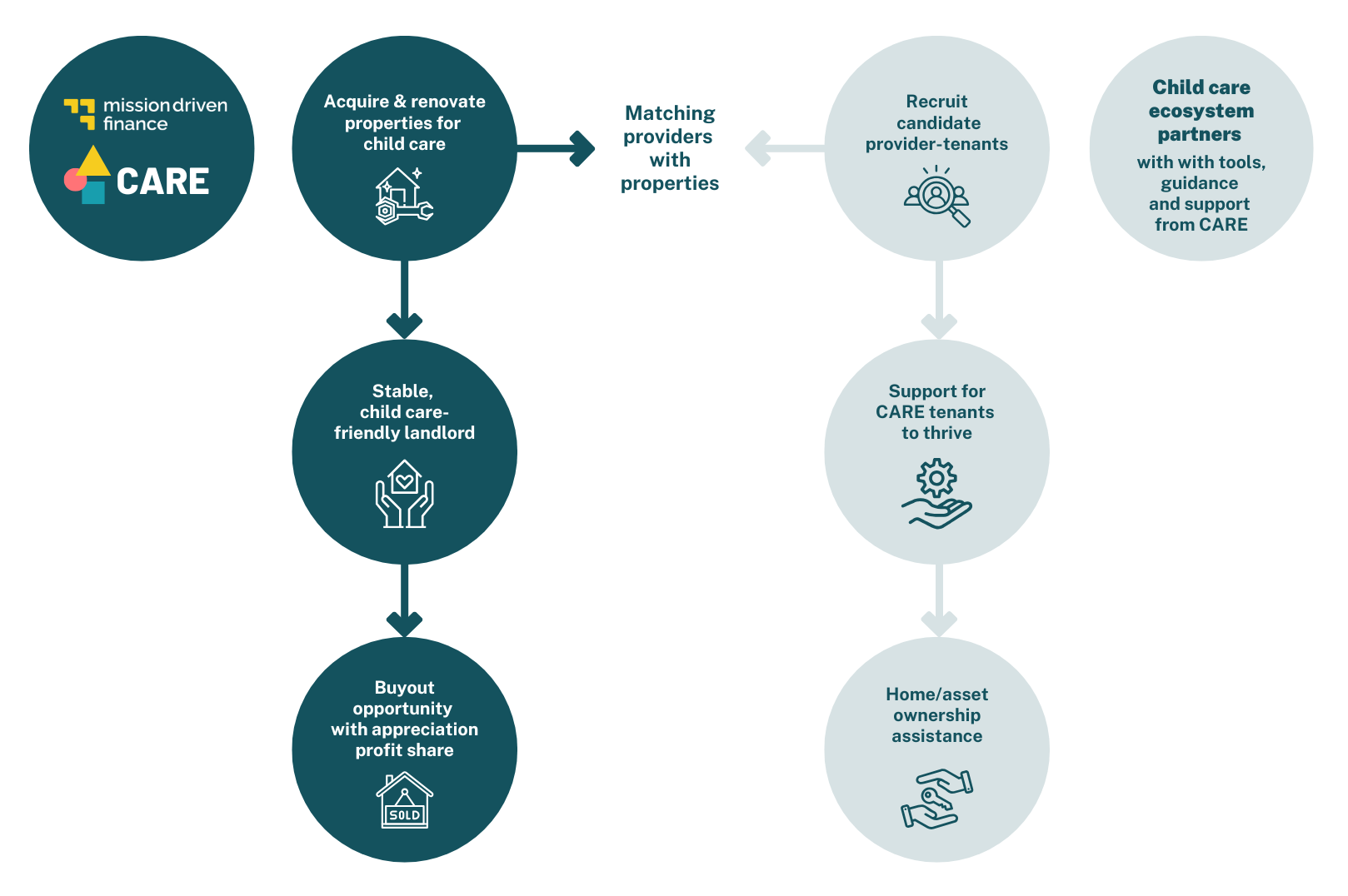

Care Access Real Estate (CARE)® addresses that common challenge by purchasing, renovating, and leasing a national portfolio of commercial and residential properties specifically designed for child care. As a child care-friendly landlord, we are committed to expanding existing quality child care and supporting center- and home-based providers in achieving their dreams.

A transformed CARE home provides natural light and a safe, fun place to learn

Impact goals

Increase and preserve quality child care capacity

Stabilize child care businesses

Increase the wealth of child care providers

We know that stable, reliable, quality child care is needed across the nation.

Here’s where we are so far*:

22 houses

in portfolio

3 nodes in operation

Nevada, California, Colorado

96 licensed child care seats created

When fully licensed, the CARE portfolio will be able to support 268 seats of child care capacity. Like a restaurant or an elevator, child care capacity is measured as the maximum number of children being cared for at a single time, but the total number of children and families served can be higher with multiple shifts of care and other factors.

*As of March 31, 2025

Learn more about investing in CARE

Sign up to receive CARE updates

CARE works with local child care ecosystems to grow from good to great

Knowing that we are just one piece of a big puzzle, we collaborate with partners who are embedded in their community. Ecosystem partners include: early education and child care nonprofits, community development finance institutions (CDFIs), and public agencies

Ecosystem partners help:

- Prioritize neighborhoods with significant child care needs and the kinds of properties optimal for licensed child care

- Identify and recruit child care providers who may be suitable CARE tenants

- Support providers to thrive in CARE properties with business, including licensing, personal finance, and quality coaching

- Recommend regional policy adjustments to best support child care facilities development

Investing in homes as child care infrastructure

Child Care Next Door

CARE acquires commercial and residential properties for child care. Curious about how child care homes work and why they matter? This 4-minute video sheds light on home-based child care as an essential feature of our nation’s child care infrastructure.

Produced with support from The National Children’s Facilities Network and United Domestic Workers Child Care Providers United

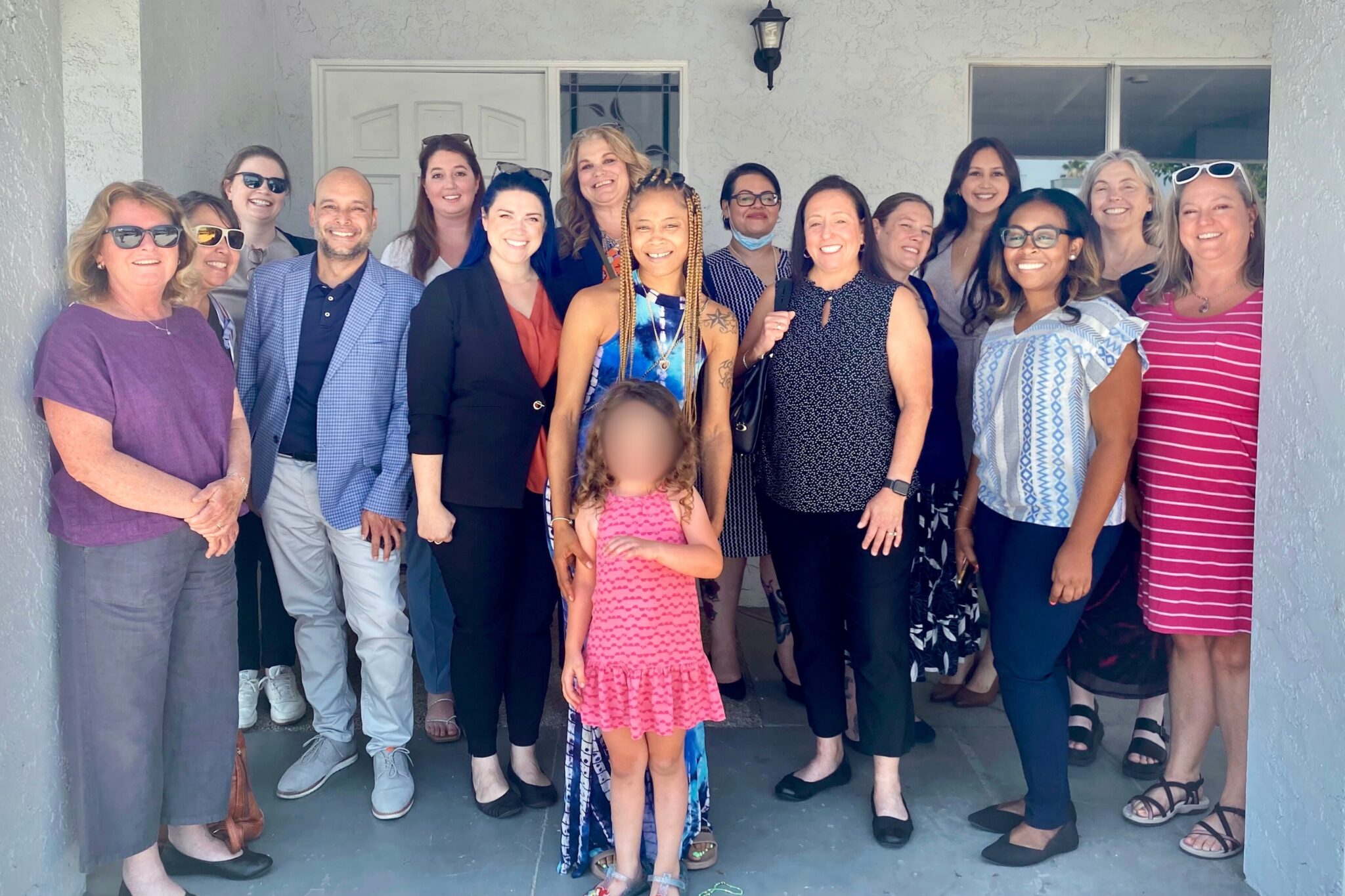

Reinforcing CARE providers serving the community

Our child care homes and facilities are operated by in-demand, experienced providers identified and supported by on-the-ground community partners. CARE leases properties to child care providers who include families under 100% of the area median income and those located in communities with insufficient child care supply.

Portfolio

Meet the child care providers

Here are some of the providers who have moved into their CARE homes.*

*The information included in this section was accurate as of the time of posting to the best of our knowledge. Provider stories and images came from the respective child care providers. This page includes a sample of the portfolio holdings that Mission Driven Finance funds invested in. A full list of portfolio companies is available upon request using the contact page or emailing the firm at info@missiondrivenfinance.com. Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable. Changes in investment strategies, contributions or withdrawals, and economic and market conditions may materially alter the performance of investments. All investments involve the risk of loss, including the possible loss of all amounts invested. Being listed on the website and the order of being listed is no reflection on the profitability of the investment.

Read more

See related press and stories

CARE REIT — Rethinking Investment in Early Education

WNHH Community Radio: Inside Voices, Community Conversations

RSF invests $11.75 million into social enterprises

Regenerative Social Finance

How can the nation expand child care options?

Federal Reserve Bank of Boston

Caring for Tomorrow: A Guide to Investing in the Care Economy

Women of the World Endowment + Tesser Capital Management

Expanding Child Care with Investments in Innovative Solutions

The Annie E. Casey Foundation

Supporting, disrupting and innovating on America’s child care solutions

Every Child Thrives by W.K. Kellogg Foundation

Real Estate's Role in Child Care

Thesis Driven

Where's My Village?

KPBS

Innovation | Points of Progress | For safer drinking water, the ingenuity of simple solutions

From the Ground Up: Improving Child Care and Early Learning Facilities

Bipartisan Policy Center

Five properties in Clark County to become new ideal child care homes

Mission Driven Finance

Quality Jobs Count: Three Key Investment Factors to Advance Economic Equity

How Universal Transitional Kindergarten Is Stressing Our Childcare System

Learn more about investing in CARE

Sign up to receive CARE updates