Food entrepreneurs and investors gathered for educational workshops and live investment presentations to catalyze funding for food ventures at this year’s Food Funded summit.

event recap

Regenerative Harvest Fund info session

Missed the Regenerative Harvest Fund info session? See the recording and slides here.

Letters from Lauren: March/April 2022

After two years of being selected for the ImpactAssets IA 50 Emerging Impact Manager list (in 2020 and 2021—an honor in itself!), this year we moved to the big kids’ table on the IA 50 Fund Manager list as we surpassed three years of track record and $25M in assets under management.

Podcast: Using Impact Investment to Build Community with David Lynn

In this podcast, Jenny Kassan and Michelle Thimesch talk with David Lynn about the origins of Mission Driven Finance and how he thinks about place-based investing.

Letters from Lauren: February/March 2022

I was honored to join The Brookings Institution for a panel discussion on the state of Black businesses in America in partnership with the Path to 15|55 initiative. The panel amplified a new Brookings report taking a regional lens on Black business ecosystems.

Equitable homeownership: Reducing the wealth gap through shared ownership models

Laura Kohn joins this Purpose webinar to discuss the power of shared ownership in building community wealth.

Mission Driven Finance participates in Brookings panel on the state of Black businesses

Learn about the current environment for Black-owned businesses and how to reimagine systems in order to create opportunities for capital and community connections.

Lauren Grattan is Named Immigration Advocate by Business for Good

Lauren Grattan was named Immigration Advocate at Business for Good San Diego’s 2021 Awards for her efforts to advance an inclusive economy.

SOCAP21 Panel on Catalytic Capital & Intersectional Equity

Through their portfolios, WES Mariam Assefa Fund, Impact America Fund, and Mission Driven Finance demonstrate how funders and investors can provide mission-driven organizations with flexible funding to innovate and scale up solutions that build more inclusive economies where everyone can contribute and thrive.

Community Finance Fellowship 2021 info session

If you missed the Community Finance Fellowship info session, check out the slides and recording here. Share with those you think are interested!

Social Impact Investing with David Cooper and Maggie Spicer

In this episode of the Essential Ingredients podcast powered by NextGenChef, host Justine Reichman talks with David Cooper—our senior portfolio advisor and co-founder of the 86 Fund—and fellow co-founder Maggie Spicer about impact investments and charitable capital investments through donor-advised funds (DAFs).

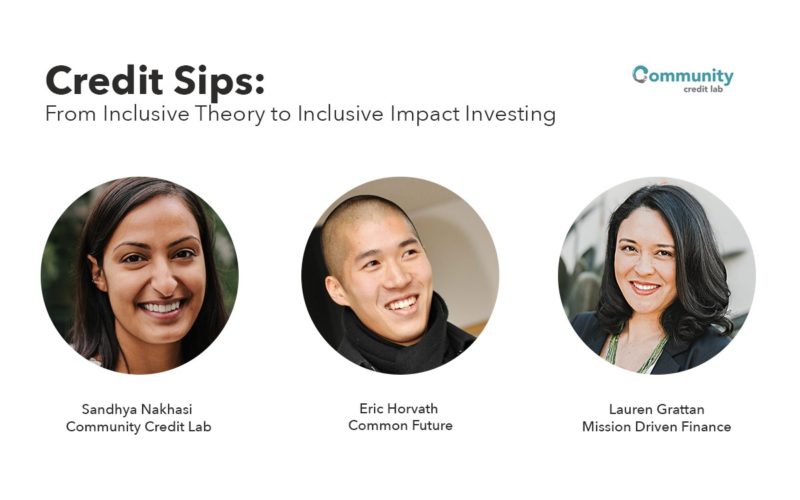

Credit Sips: From Inclusive Theory to Inclusive Impact Investing

Sandhya Nakhasi of Community Credit Lab, Eric Horvath of Common Future, and Lauren Grattan of Mission Driven Finance discuss how they are using impact investing to build inclusive financial systems by centering communities.

Transformative 25 Funds Creative Financing

Fund managers from Fair Food Network, Homestake Venture Partners, Flexible Capital Fund, Kachuwa Impact Fund, and Mission Driven Finance engage in a lively discussion about creative financing and integrated capital strategies. Moderated by Esther Park, CEO of Cienega Capital.

Catalyst’s Impact Investing Series: Strategic investments in small businesses to sustain resilient communities

Hear from peer funders and investors on lessons learned in providing entrepreneurship funding and technical assistance for small businesses. Leave with practical strategies that you can explore and implement in your post-COVID resiliency funding.

Asian Pacific Islander Businesses of the Year Awards 2021

In honor of Asian American and Pacific Islander Heritage Month, the San Diego Business Journal and Asian Business Association San Diego presented Asian Pacific Islander Businesses of the Year Awards and a panel discussion that included our Chief Investment Officer Louie Nguyen. Congratulations to portfolio company Microtek took home the “Most Innovative” Business of the Year Award.

Philanthropy Now podcast: Multiplying grantmaking power with impact investing

Hear how impact investing differs from traditional grantmaking, and how this philanthropic tool leverages financial capital and human resources to get important community projects off the ground. Learn how Mission Driven Finance, Social Finance, and Silicon Valley Community Foundation use this model to support especially underserved communities and address inequities in affordable housing, education, and more.

High ROI: Inclusive talent development strategies for the investment field

James Benedict (Left Tackle Capital), Deborah Frieze (Boston Impact Initiative), and Lauren Grattan (Mission Driven Finance) discuss different approaches to develop and empower more representative talent in the investment industry in this ASBC-SVC Spring 2021 session.

AIA New York Civil Leadership Program: Zoning and Shared Equity Housing

In this session, Mission Driven Finance CEO David Lynn spoke about potential financing structures for community land trusts and similar affordable housing ventures.