Food entrepreneurs and investors gathered for educational workshops and live investment presentations to catalyze funding for food ventures at this year’s Food Funded summit.

insights

Regenerative Harvest Fund info session

Missed the Regenerative Harvest Fund info session? See the recording and slides here.

The Care Guild list of people reimagining and rehumanizing our care system

Meet the people doing the most exciting, elegant work today in easing the financial way for caregivers and expanding economic opportunity for the historically marginalized.

Podcast: Using Impact Investment to Build Community with David Lynn

In this podcast, Jenny Kassan and Michelle Thimesch talk with David Lynn about the origins of Mission Driven Finance and how he thinks about place-based investing.

Equitable homeownership: Reducing the wealth gap through shared ownership models

Laura Kohn joins this Purpose webinar to discuss the power of shared ownership in building community wealth.

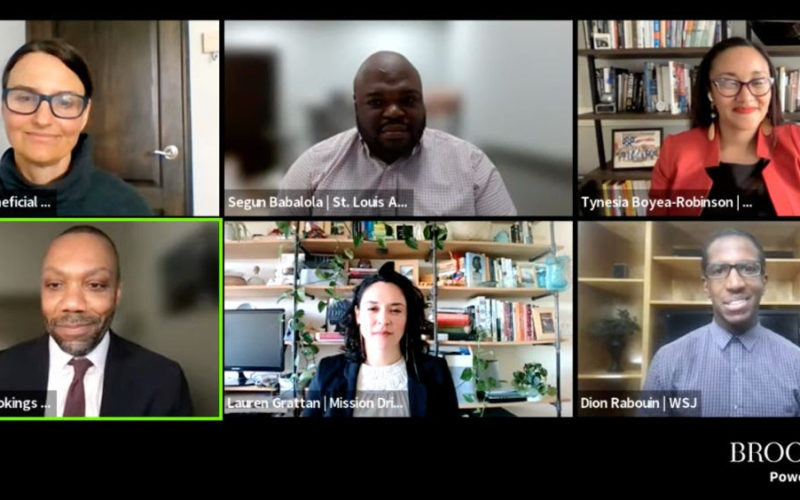

Mission Driven Finance participates in Brookings panel on the state of Black businesses

Learn about the current environment for Black-owned businesses and how to reimagine systems in order to create opportunities for capital and community connections.

[Video] Child Care Next Door: Investing in Homes as Child Care Infrastructure

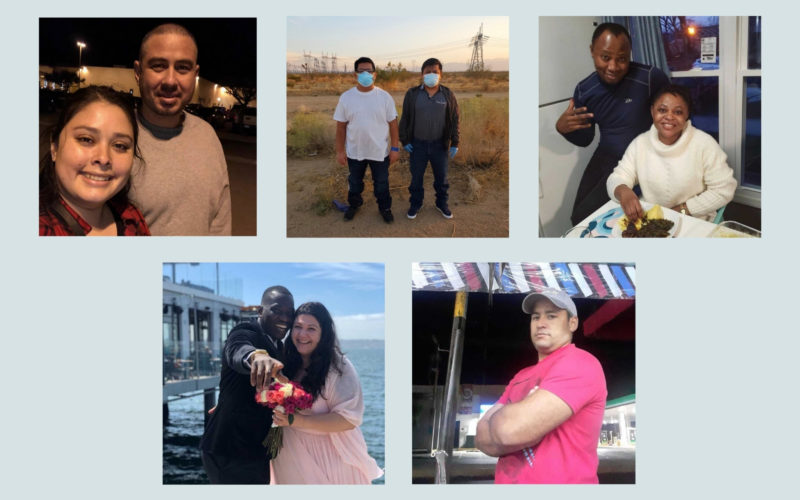

Three family child care providers share their stories in a video produced by Mission Driven Finance in partnership with the National Children’s Facilities Network.

SOCAP21 Panel on Catalytic Capital & Intersectional Equity

Through their portfolios, WES Mariam Assefa Fund, Impact America Fund, and Mission Driven Finance demonstrate how funders and investors can provide mission-driven organizations with flexible funding to innovate and scale up solutions that build more inclusive economies where everyone can contribute and thrive.

What’s a B Corp and why become one? Mission Driven Finance shares insights.

“Impact is a team sport and we all have a role to play, for-profit businesses included,” says Chief Community Officer Lauren Grattan. “B Corps embrace the idea that doing good is good business.”

Ownership Matters highlights Mission Driven Finance

This conversation took place between Elias Crim of Ownership Matters—a biweekly newsletter for the founders and funders of the emerging solidarity economy—and Mission Driven Finance’s co-founder and CEO, David Lynn, and Lauren Grattan, co-founder and Chief Community Officer.

What we learned while recruiting for the 2021 Community Finance Fellowship

This year, we opened the fellowship application to candidates nationwide. We received applications from 13 states, Washington, DC, and even one from another country!

Fifty by Fifty Employee Ownership News: Employee Ownership Catalyst Fund Preserves Local Businesses and Jobs

Project Equity and Mission Driven Finance announced on Labor Day the launch of the Employee Ownership Catalyst Fund, an evergreen debt fund that will offer flexible financing to businesses preparing for—or executing—an employee ownership transition. The fund targets businesses across the U.S. with 25 to 100-plus employees, particularly those employing frontline, low-wage workers and workers of color.

Opinion: Here’s how we can help middle-income families in San Diego buy homes

How can investors and local business and nonprofit leaders address housing — and in particular attainable homeownership — through public-private partnerships? Our Chief Investment Officer Louie Nguyen looks at various approaches.

Community Finance Fellowship 2021 info session

If you missed the Community Finance Fellowship info session, check out the slides and recording here. Share with those you think are interested!

Social Impact Investing with David Cooper and Maggie Spicer

In this episode of the Essential Ingredients podcast powered by NextGenChef, host Justine Reichman talks with David Cooper—our senior portfolio advisor and co-founder of the 86 Fund—and fellow co-founder Maggie Spicer about impact investments and charitable capital investments through donor-advised funds (DAFs).

The Freedom100 Fund shows we can treat immigrants with dignity, not detention

Through a combination of impact-first finance, a coalition of dedicated philanthropic and impact investors, and an incredible organization advocating for immigrant dignity, 100 people are now free from immigrant prison.

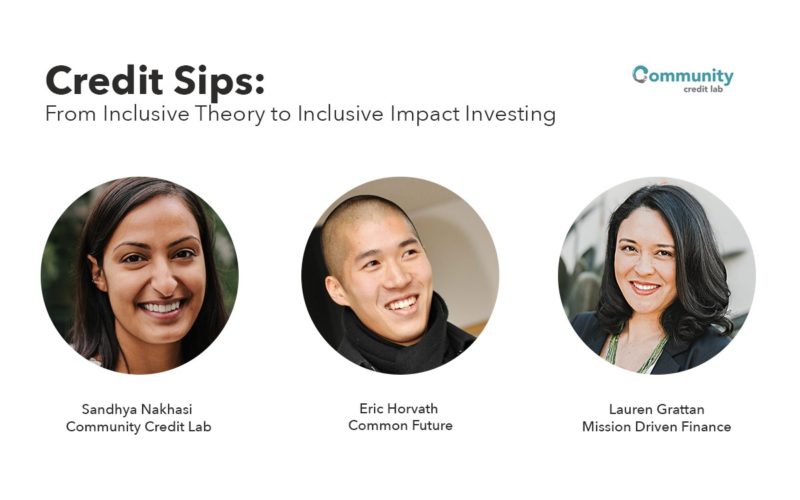

Credit Sips: From Inclusive Theory to Inclusive Impact Investing

Sandhya Nakhasi of Community Credit Lab, Eric Horvath of Common Future, and Lauren Grattan of Mission Driven Finance discuss how they are using impact investing to build inclusive financial systems by centering communities.

Transformative 25 Funds Creative Financing

Fund managers from Fair Food Network, Homestake Venture Partners, Flexible Capital Fund, Kachuwa Impact Fund, and Mission Driven Finance engage in a lively discussion about creative financing and integrated capital strategies. Moderated by Esther Park, CEO of Cienega Capital.

![[Video] Child Care Next Door: Investing in Homes as Child Care Infrastructure](https://www.missiondrivenfinance.com/wp-content/uploads/2023/05/CARE-video-providers-800x500.jpg)