We’re welcoming summer, (safe) gathering, and new fund launches with our partners—and still mourning that the long battles against COVID-19 and systemic bias continue.

Advance

Letters from Lauren: May/June 2022

Reflecting on Memorial Day and the second anniversary of George Floyd’s murder, it’s easy to feel like we’re treading water as a society. But we believe in the power of freedom dreams and radical imagination to continue building a future that works for all.

Innovative real estate that is a win for the local economy and the environment

Hilltop Crossing, a new development in San Diego, not only creates middle-income housing but also engages diverse subcontractors and includes energy-efficient features.

Letters from Lauren: March/April 2022

After two years of being selected for the ImpactAssets IA 50 Emerging Impact Manager list (in 2020 and 2021—an honor in itself!), this year we moved to the big kids’ table on the IA 50 Fund Manager list as we surpassed three years of track record and $25M in assets under management.

Letters from Lauren: February/March 2022

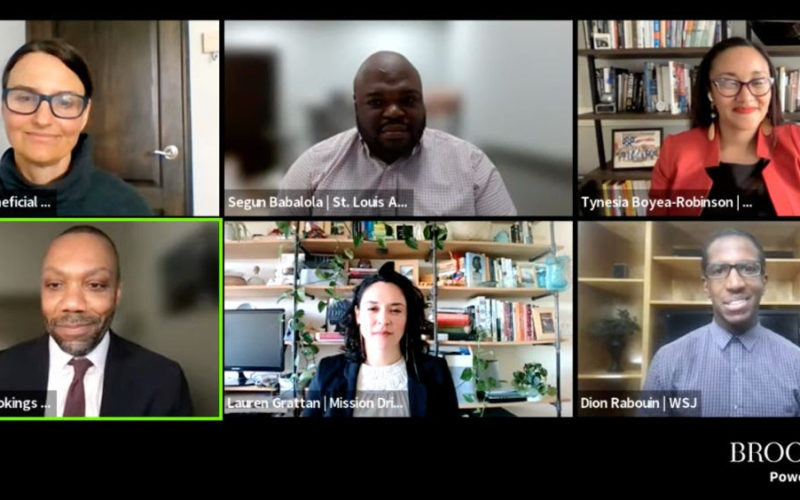

I was honored to join The Brookings Institution for a panel discussion on the state of Black businesses in America in partnership with the Path to 15|55 initiative. The panel amplified a new Brookings report taking a regional lens on Black business ecosystems.

Meet the members of new committee supporting integrity of flagship fund

Meet the ten regional community champions ensuring the flow of Advance Strategy capital to underserved and overlooked communities.

New advisory committee ensures money flows to San Diego small businesses & nonprofits

The Advance Advisory Committee collaborates with Mission Driven Finance to flow capital more equitably to small businesses and nonprofits.

Construction begins on Hilltop Encanto attainable housing project

The successful exit of the pre-development loan means construction has started! The first phase is scheduled to be completed in 2022.

Growing like wildflowers

Earlier this year we shared some exciting and bittersweet team changes. Now that we are heading into the final quarter of the year, we want to share more about how our team is growing.

What we learned while recruiting for the 2021 Community Finance Fellowship

This year, we opened the fellowship application to candidates nationwide. We received applications from 13 states, Washington, DC, and even one from another country!

Opinion: Here’s how we can help middle-income families in San Diego buy homes

How can investors and local business and nonprofit leaders address housing — and in particular attainable homeownership — through public-private partnerships? Our Chief Investment Officer Louie Nguyen looks at various approaches.

Announcing some exciting (and bittersweet) team changes

As Mission Driven Finance celebrates its fifth year flowing capital to community, we have seen our company grow and change many times, especially given our focus on being a deliberately developmental organization. This season feels like one of great change even with that mindset, and we want to make sure you learn about the latest team changes at Mission Driven Finance.

Catalyst’s Impact Investing Series: Strategic investments in small businesses to sustain resilient communities

Hear from peer funders and investors on lessons learned in providing entrepreneurship funding and technical assistance for small businesses. Leave with practical strategies that you can explore and implement in your post-COVID resiliency funding.

What we learned in our very first Community Finance Fellowship

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

Local impact investment firm Mission Driven Finance marks 5th anniversary with $11 million milestone

Marking two major milestones, we are celebrating our fifth anniversary this month as well as having disbursed $11 million in assets to the small businesses and nonprofits dedicated to social change in the region.

Why I invest: Rachel Lozano Castro

One of the youngest people to support Mission Driven Finance portfolio companies, Rachel Lozano Castro leaned into her passion and know-how to organize a shared donor-advised fund (DAF) with her family that supports our flagship place-based strategy Advance.

Community Finance Fellowship showcase

Hear directly from the 2020 cohort fellows— Andrew Moncada, Essence Rodriguez, Louise Jordan, Crystal Sevilla, and Benson Ochira—about their career goals and their experiences thus far changing the face and flow of finance.

WES Mariam Assefa Fund Spotlights Mission Driven Finance

WES Mariam Assefa Fund, one of the visionary supporters of the Community Finance Fellowship, spotlights Mission Driven Finance.