The COVID-19 crisis has forced small businesses and nonprofits around the world, including our Advance borrowers, to forget business as usual and respond in creative ways to best serve their community and survive—quickly. From delivering essential household goods and locally sourced food to staying connected with families by livestreaming nature walks, these businesses and organizations demonstrate the flexibility, resilience, and heart that make small businesses critical for communities to thrive.

Advance

Finding the way back through evidence-based holistic treatment

The Way Back uses trauma-informed care in its client activities—clinical groups, education groups, mindfulness meditation, relapse prevention groups, codependency groups, anger management, emotional regulation, and individual psychotherapy. “We are training men to be better fathers, better husbands, better employees, to stay out of prison, to work, to communicate,” says The Way Back Executive Director Chris Thomas, a licensed therapist who has been sober for 25 years. “Men are an important part of family structure, and addiction is a family disease.”

AdvanceHER: Unlocking opportunities for women and girls in San Diego and abroad

In our quest to increase economic opportunity for underestimated groups, we knew we’d want to emphasize supporting women and girls. With a diverse and largely female team, empowering more women has always felt natural to us. We’ve long wanted to connect the resources and needs of our community in new intentional ways that make a real impact on gender inequality.

Our team reflects on 2019 and looks forward to 2020

With 2019 officially behind us, our team took a second to celebrate our favorite wins, which helps us to also look forward and set goals for 2020.

Insights From Innovators—interview with Cutting Edge Capital

Cutting Edge Capital spoke with Mission Driven Finance Co-founders Lauren Grattan and David Lynn to talk about our mission, and how our community-first perspective guides us to find investment opportunities.

Closing education gaps with creative capital

Our flexible, personalized financing approach allowed us to provide Friends of Willow Tree a $100,000 bridge loan that they used for expenses at the start of the school year, keeping the program affordable and accessible for their majority low-income students.

How can we make investing in our community a great investment? Flip the conventional finance model on its head.

The idea for Advance came from speaking with people who wanted to invest in their communities and the issues that they cared about but didn’t know how.

Developing community with creative capital

When we first met Kris Schlesser, founder of LuckyBolt, he was six years into a quest to make the perfect breakfast burrito easily accessible to professionals on the go, and had been financing the business with high-interest credit cards and microloans.

Thoughts from the road: Small business drives strong communities across the country

David and Lauren spent National Small Business Week on the road in New York; Columbus, Ohio; and Baton Rouge, Louisiana. They spoke with stakeholders from different walks of life who all recognize the transformative power of small business from varied angles.

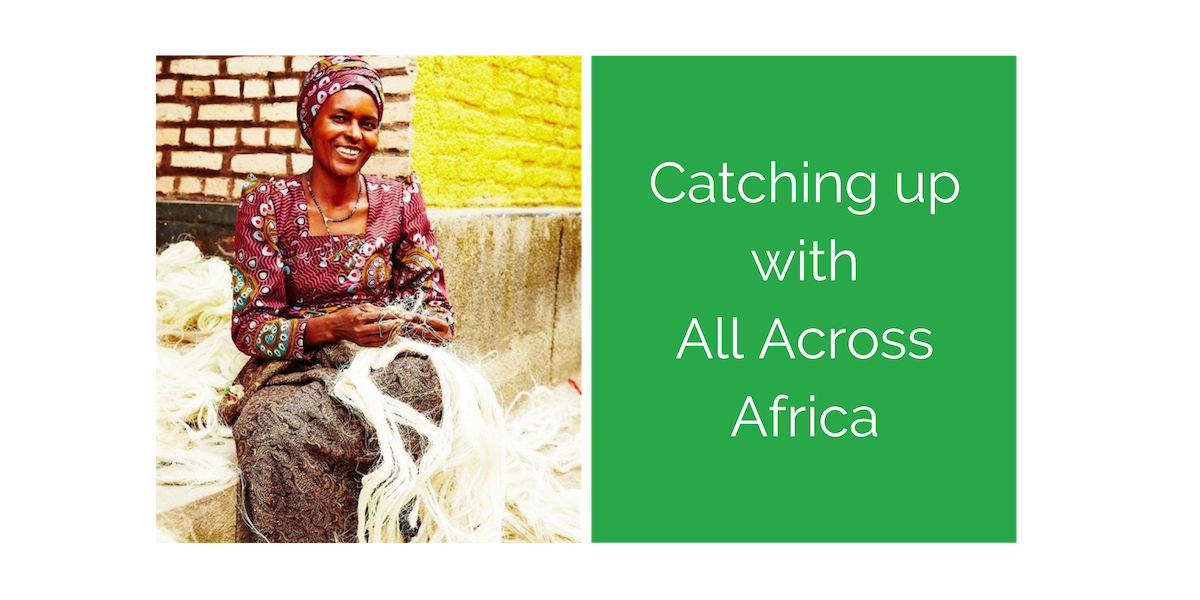

Supporting African artisans at work and beyond

“I have managed to invest…but one of the proudest things I have been able to do is pay for all of the school fees for my 7 children.”

—Seraphine, artisan

NPR: Breaking the cycle of disinvestment In lower-income communities

Our conversation with NPR about discrepancies in access to capital for lower-income communities and how we can level the playing field.

Collaborative approach unlocks $12M project transforming youth lives

Mission Driven Finance, Civic San Diego, and a local foundation unlock $12MM for nonprofit Access Youth Academy’s facility in Southeast San Diego.

How to align with Islamic financing principles to create economic opportunity

Mission Driven Finance provides culturally sensitive bridge financing to Somali Family Service of San Diego in accordance with Islamic financing principles.

Borrower Spotlight: LuckyBolt

The $250,000 loan from Mission Driven Finance enables LuckyBolt to expand from a shared commissary kitchen to their own commercial kitchen and storefront.

Borrower Spotlight: All Across Africa

All Across Africa’s unique supply chain model includes training and employing over 3,000 artisans in five countries in Africa, primarily women.

Borrower Spotlight: Thrive Public Schools

Meet our borrowers: Thrive Public Schools and see how they are preparing students to be college-ready, career-informed, and community-minded.